A highly competitive aftermarket - as we know it today - contributes to individual mobility being an option for many. With the ongoing technology shift, there is a real risk that this will change. An analysis prepared for the trade associations CLEPA (European Association of Automotive Suppliers) and FIGIEFA (Automotive Aftermarket Distributors) by Berylls identifies the most important key factors that have the potential to change the aftermarket as we know it today. At the same time, it suggests how the key factors may drive a shift in the existing market balance between the independent (IAM) and authorized (OES) aftermarket.

The following is a continuation of the article with the same headline from Triscan News no. 46 published in June 2025. If you haven't read PART 1, it can be found here: What are the possible consequences of the technology shift for the independent aftermarket?

The two most likely future scenarios

Based on Beryll's prediction of the market development and the identification of the presumably five most important parameters that may affect the balance in the market distribution between OES and IAM, Berylls considers the two following scenarios to be the most likely:

- OES dominance

- Market liberalisation

OES dominance

In the scenario of OES dominance, OEMs maintain the influence gained through the technology shift by not being subject to additional obligations under the regulatory framework. In doing so, they maintain control over bonded parts, unlimited implementation of cybersecurity measures, control of software updates, no additional obligations to provide RMI/OBD data, and a gatekeeper role in remote access to vehicle functions and resources.

In such market conditions, IAM's ability to compete effectively will be significantly limited. In the absence of alternatives, OEMs will be able to control the prices of services and technical information (e.g. procurement of RMI/OBD information, access certificates for diagnostics, OEM tools or software updates). This will most likely increase costs for the IAM network and leave consumers with limited repair options.

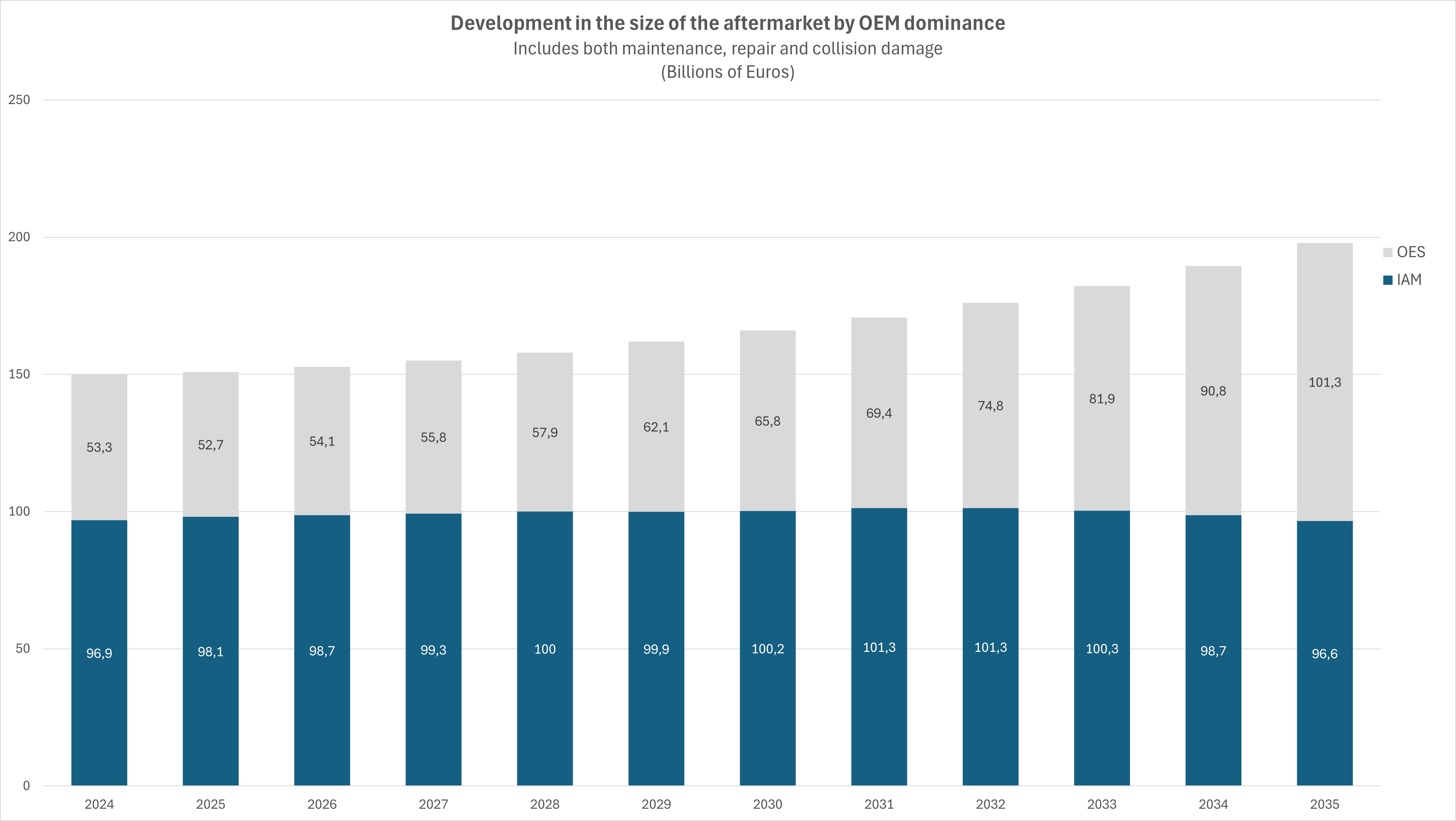

Evolution in the size of the aftermarket by OEM dominance – Fig. 7

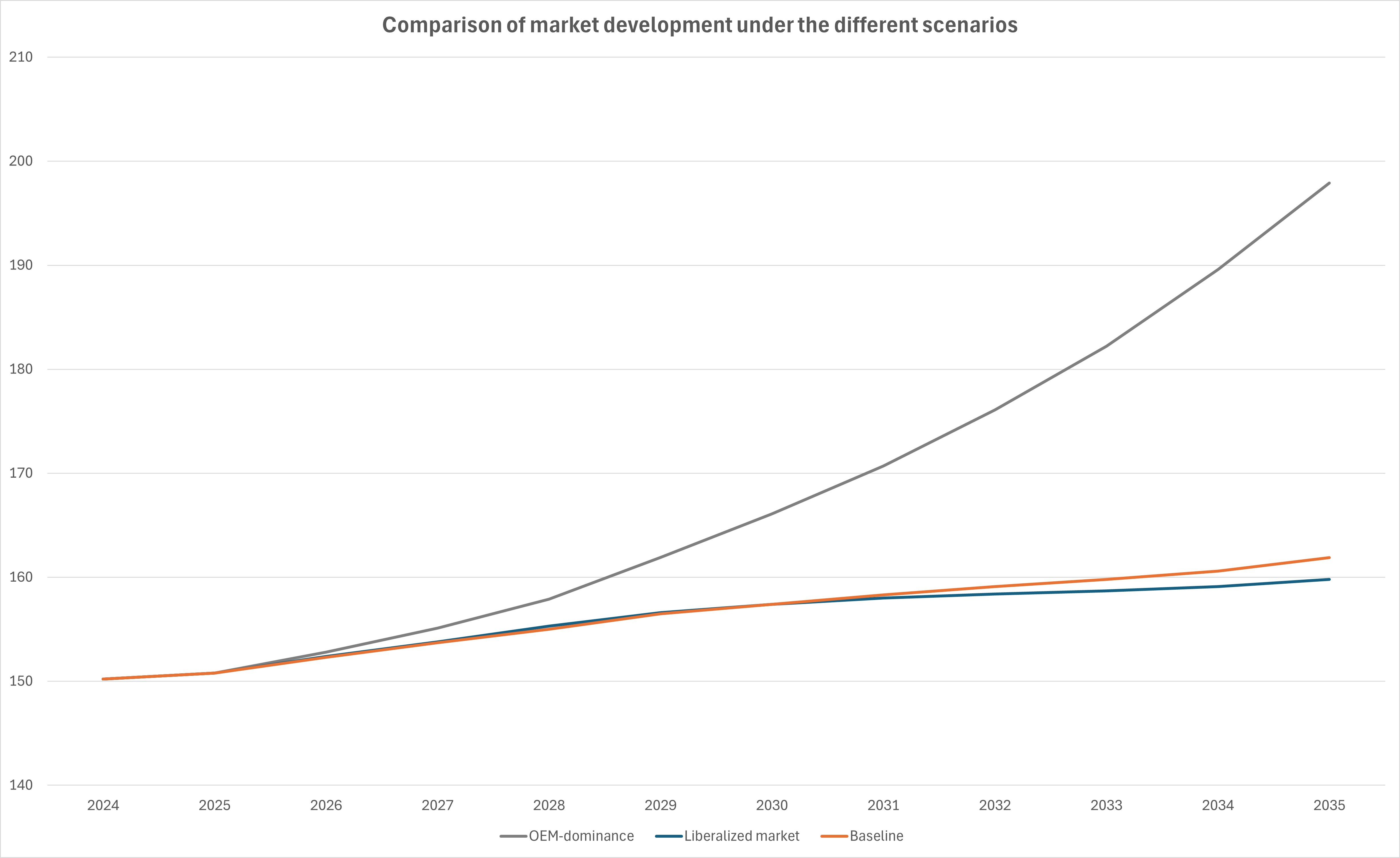

Although the number of servicing remains at the same level, the size of the market will increase significantly from the baseline, as shown in the chart below. As a result, consumers in target markets will have to spend an additional EUR 36 billion by 2035 on the same number of repair and maintenance services as in the baseline. The cumulative difference between scenario 1 and the baseline amounts to EUR 136 billion for the period 2025-2035.

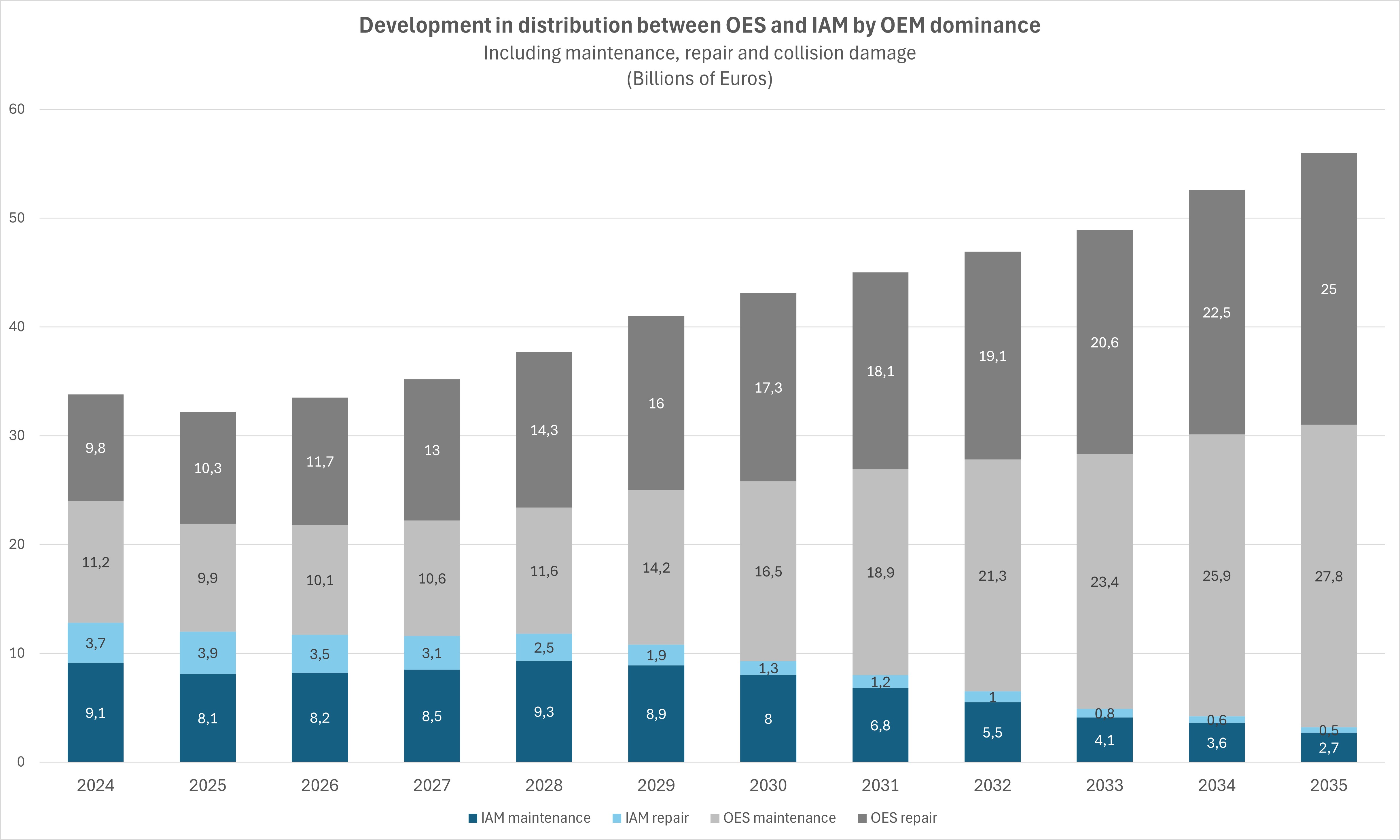

Development in distribution between OES and IAM at OEM dominance – Fig. 8

In particular, in this OES dominance scenario, a significant portion of IAM revenue goes directly to vehicle manufacturers or other companies. This is due to the increased reliance on bonded parts, cybersecurity measures, RMI/OBD data, and software updates. By 2035, 14% of the total market (EUR 27.8 billion) will be attributable to such imposed revenue shares.

Market liberalisation

This scenario assumes that the market will implement significant regulatory changes aimed at ensuring fair competition and thus ensuring that IAM can compete on equal terms with OES. The legislation will ensure increased access to bonded parts, enable competitive software updates, enable the replacement of parts protected by cybersecurity measures, and improve access to RMI/OBD data, as well as remote access to in-vehicle data and resources.

Compared to the baseline, the total market size is estimated to have a slightly lower growth rate because OEMs are not free to impose price surcharges. IAM, on the other hand, can maintain its share of the overall market and consumers will benefit from lower repair costs.

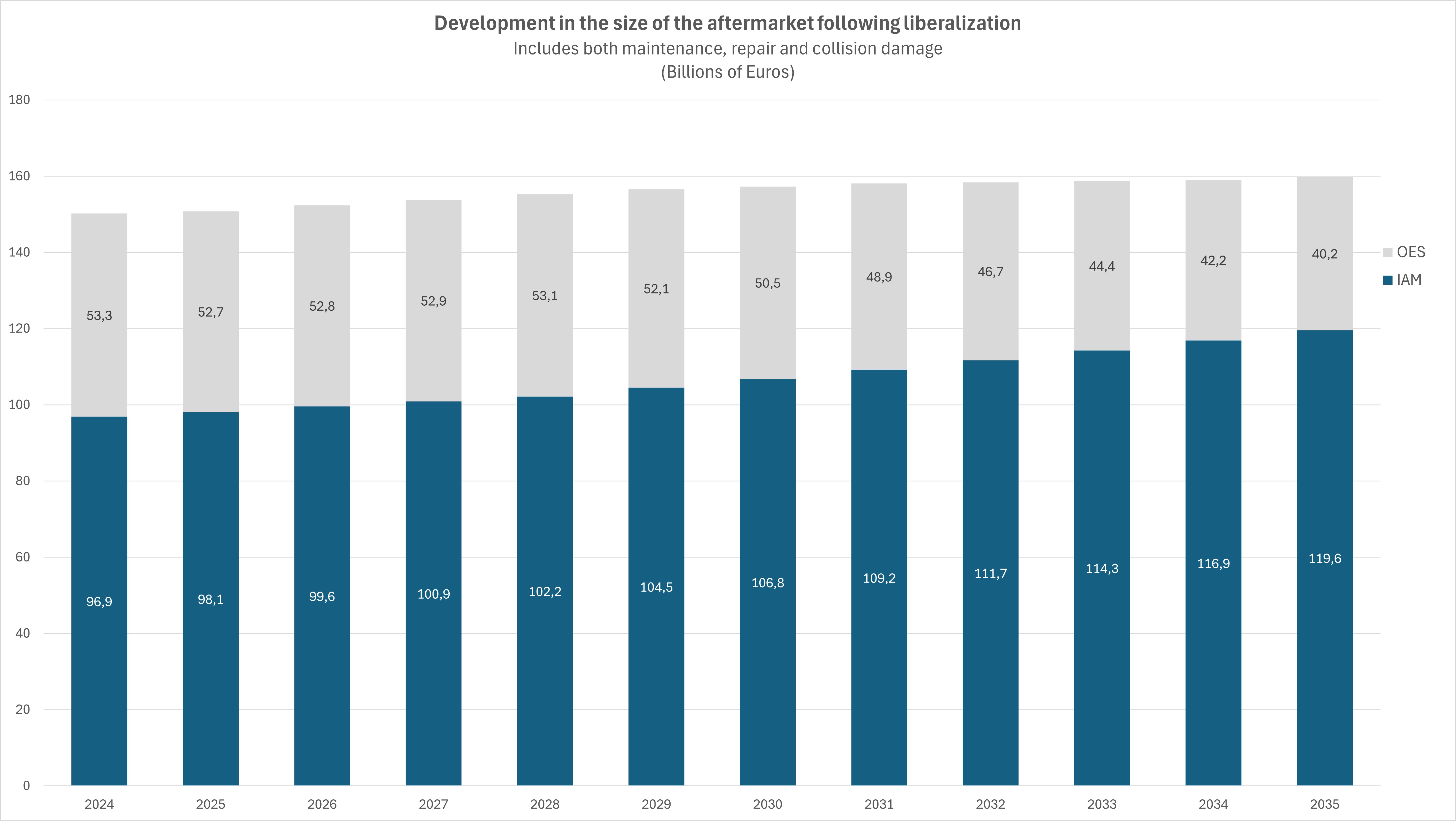

Development in the size of the aftermarket through liberalisation – Fig. 9

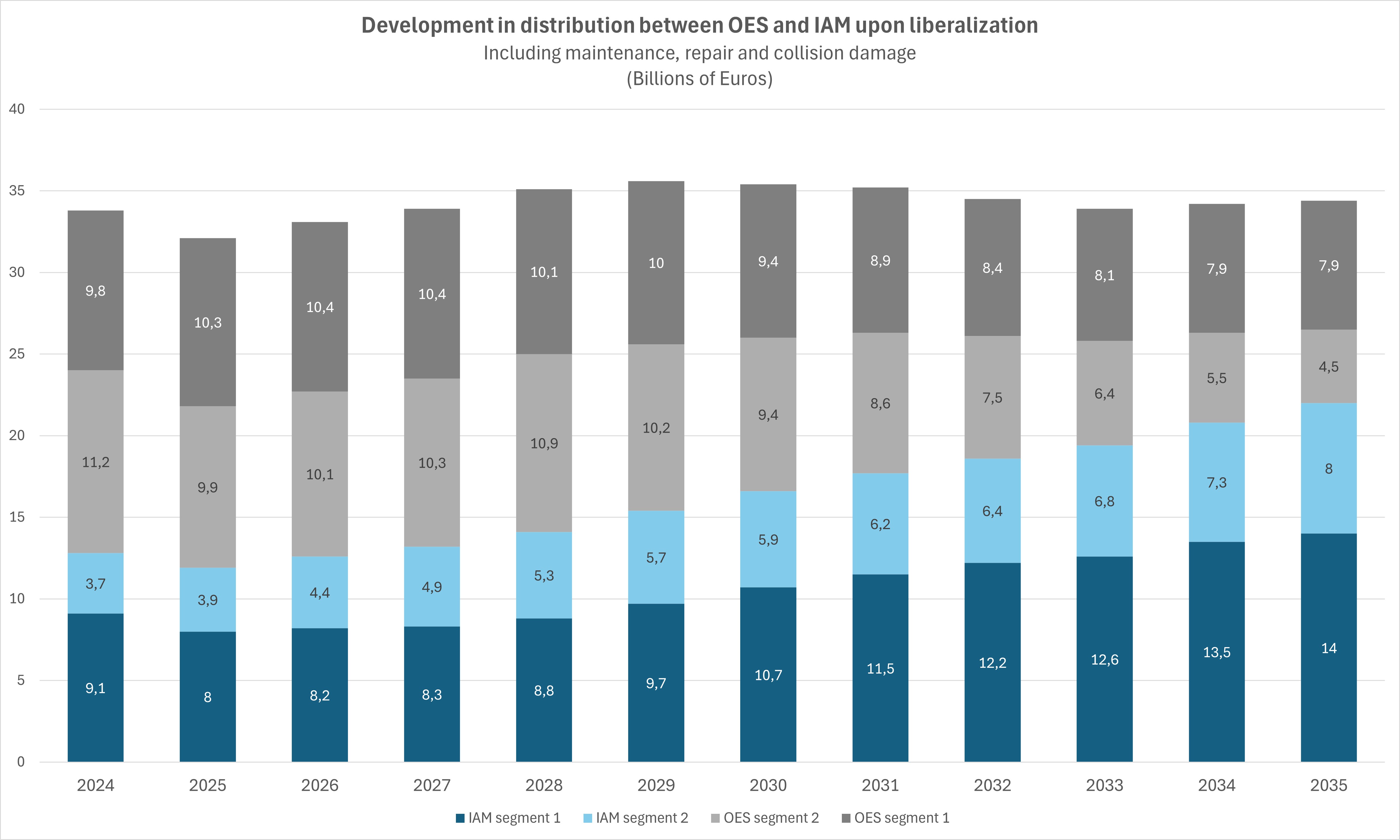

The main drivers that IAM offers consumers are competitive prices and service options. It is therefore estimated that access to critical information and parts will slightly increase the competitiveness of IAM in segments 1 and 2.

Even in a liberal market scenario, a significant part of IAM revenues would directly benefit vehicle manufacturers or other companies in the value chain. Bonded parts, as well as cybersecurity measures, are all subject to fees – and will thus generate new revenue streams for car manufacturers and other businesses. By 2035, 4% of the total market (€7.1 billion) will be attributable to imposed revenue shares.

Evolution of the distribution between OES and IAM through liberalisation – Fig. 10

Comparison of the two scenarios

When comparing the two scenarios, it becomes clear that OES stands to gain significantly in contrast to IAM. Even if there are significant market shifts towards IAM, this will only result in a significantly lower TAM (Total Addressable Market) compared to the baseline.

Comparison of market developments in the different scenarios – Fig. 11

This is driven by the additional fees and costs that IAM players incur through higher tied parts prices and fees related to cybersecurity measures and activating or coding parts. While the relevant revenues are primarily attributed to IAM, in practice car manufacturers reap a large part of the benefit from selling tied parts to IAM - and from the fees they charge for their actuation.

Strategic recommendations to the IAM

The five identified parameters will significantly disrupt the power dynamics between OEM and IAM. In the scenario of OEM dominance, all parameters have the potential for long-lasting lock-in effects, tying vehicles in all segments and their owners to the services of the OES channel. It is therefore crucial for consumers/vehicle owners that the ability of IAM channels to compete or provide services is maintained. Second, parameters 1 to 4 will significantly affect consumer prices. If the price development does not remain moderate for vehicles with new technology, vehicles in segment 3 will not apply to the IAM channels.

The ongoing technology shift in the aftermarket is a shift towards monopoly-like conditions if legislation is not introduced that ensures the interest of consumers and IAM fair conditions of competition. Regardless of which of the two scenarios will play out, it is important that players in the IAM channel focus on the following focus areas in order to be best equipped for the battle for customers in the future:

- Improve service availability and efficiency

- Invest in advanced diagnostic tools and training

- Alignment with cybersecurity protection measures

- Use business models based on in-vehicle data

- Strengthen industry collaboration

Strengthened industry cooperation remains the best tool to influence, promote and demand that the interests of both consumers and IAM are best served through:

- Access to cybersecurity-relevant information

- Access to vehicle repair and maintenance data

- Access to software updates

- Remote access to vehicle-mounted data

ABBREVIATIONS USED

ADAS (Advanced Driver Assistance Systems)

BEV (Battery Electric Vehicles)

CAGR (Compound Annual Growth Rate)

CLEPA (European Association of Automotive Suppliers)

CSMS (Cyber Security Management System)

ECU (Electronic Control Unit)

FIGIEFA (Automotive Aftermarket Distributors)

HMI (Human Machine Interface)

IAM (Independent Aftermarket)

ICE (Internal Combustion Engine)

KIF (Key Influencing Factors)

MVBER (Motor Vehicle Block Exemption Regulation)

OBD (On Board Diagnostics)

OEM (Original Equipment Manufacturer)

OES (Original Equipment Supplier)

OTA (Over-The-Air)

RMI (Repair and Maintenance Information)

RSS (Remote Support Service)

SDV (Software Defined Vehicles)

SGL (Supplementary Guidelines)

TAM (Total Addressable Market)

TAR (Type-Approval Regulation)