A highly competitive aftermarket - as we know it today - contributes to individual mobility being an option for many. With the ongoing technology shift, there is a real risk that this will change. An analysis prepared for the trade associations CLEPA (European Association of Automotive Suppliers) and FIGIEFA (Automotive Aftermarket Distributors) by Berylls identifies the most important key factors that have the potential to change the aftermarket as we know it today. At the same time, it suggests how the key factors may drive a shift in the existing market balance between the independent (IAM) and authorized (OES) aftermarket.

The analysis and the market models used to predict the expected market development are based on data from seven selected key markets: Germany, France, Italy, Spain, the United Kingdom, Poland and Norway. The respective fleets of the seven countries account for 67% of the total European fleet. In addition, interviews have been conducted with highly recognized experts across the entire aftermarket value chain.

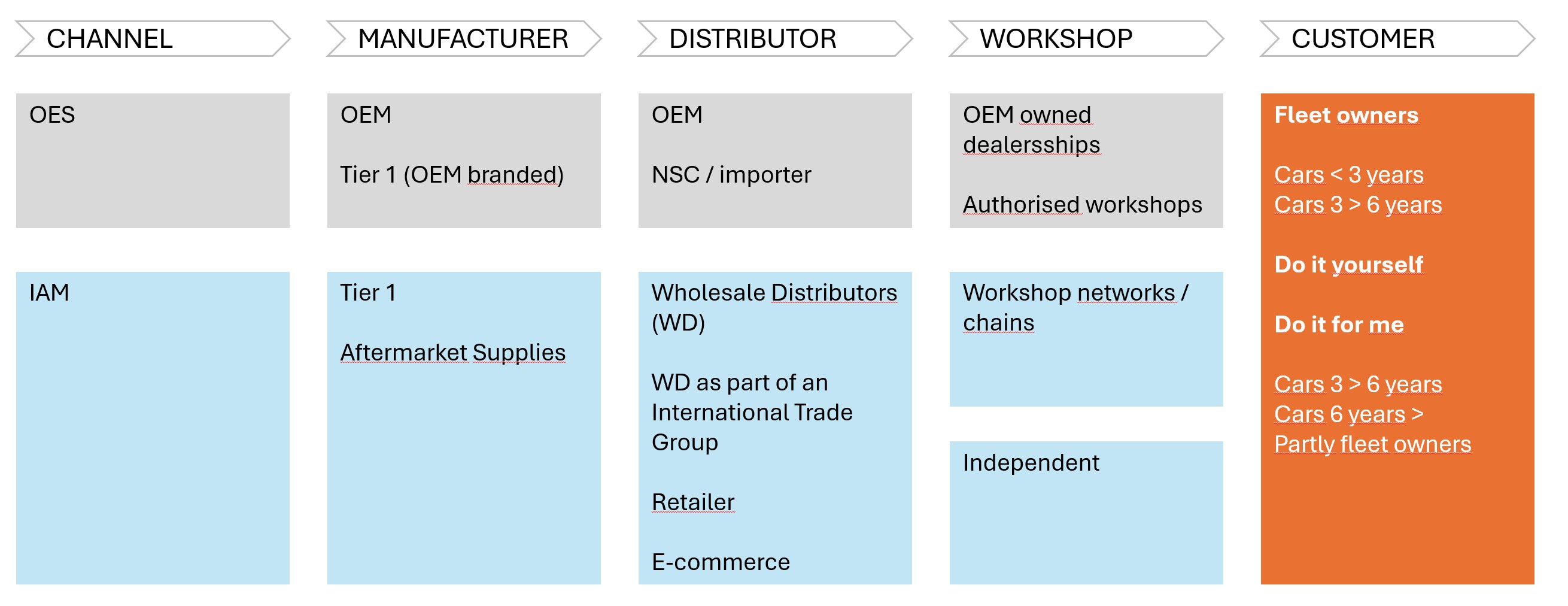

The value chain in the aftermarket – Fig. 1

MARKET DEVELOPMENT

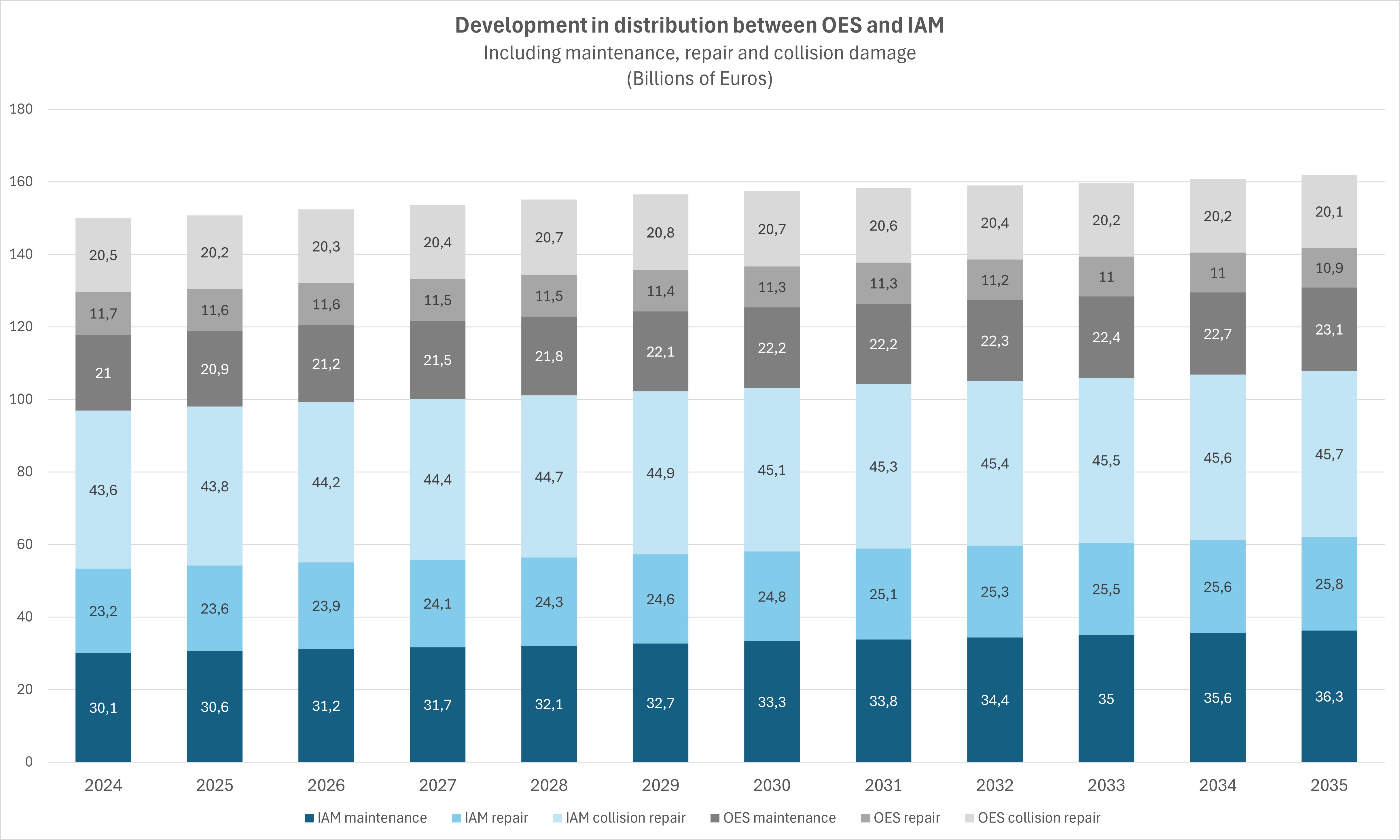

The aftermarket in the seven markets has grown significantly in recent years, increasing from €130.6 billion in 2015 to €150.2 billion in 2024. Market reports also show that only 35% of cars over the age of six are serviced in the OES channel.

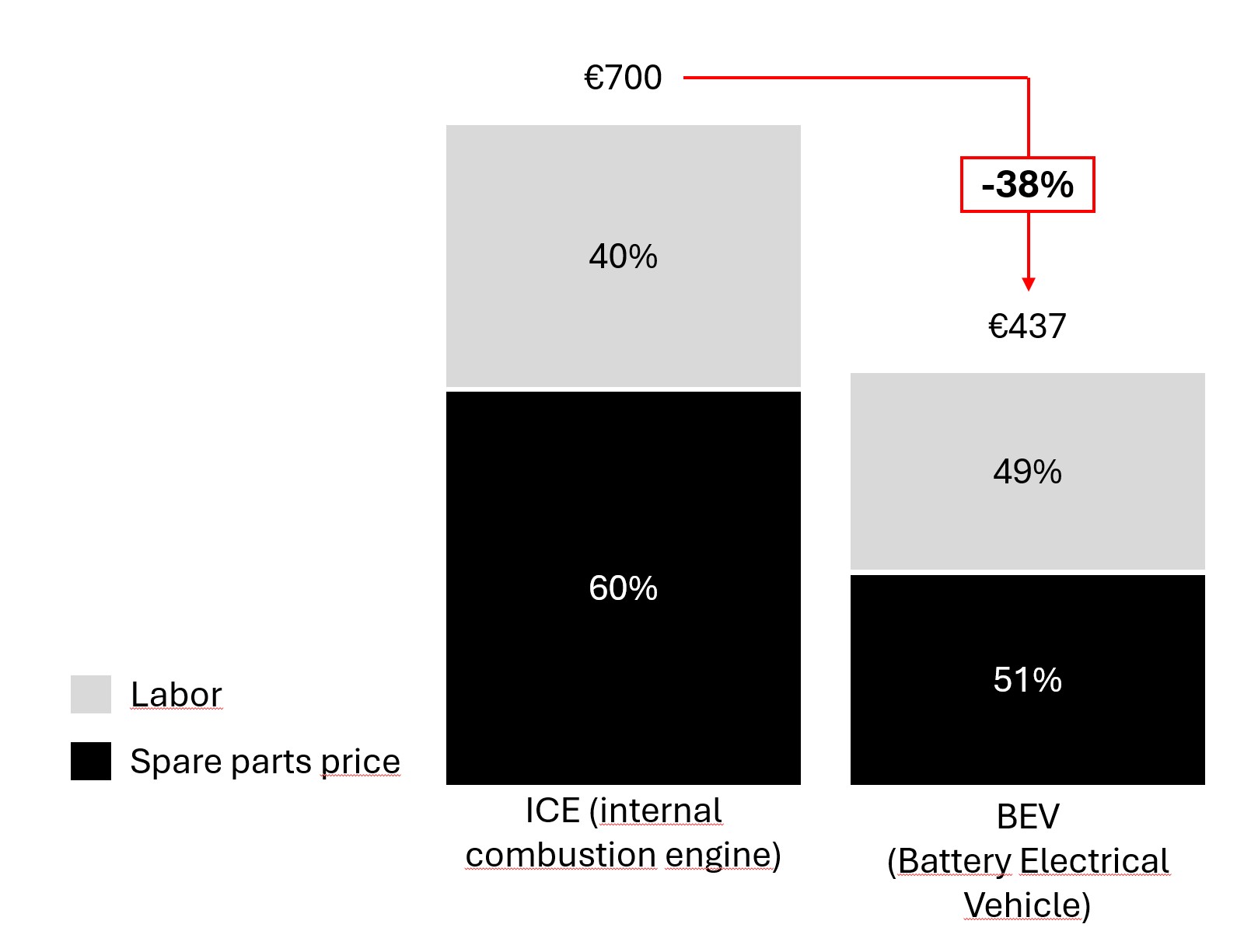

As a result of a more simplified powertrain in battery powered vehicles (BEVs) / software-defined vehicles (SDVs), this type of car requires significantly less maintenance of mechanical parts than traditional internal combustion engine vehicles. In turn, other types of service and repair tasks related to battery systems, control of electronic components and software will be necessary. Overall, however, a decline in aftermarket revenues for this type of vehicle is expected.

Reduced costs for maintenance and repair of BEV/SDV – Fig. 2

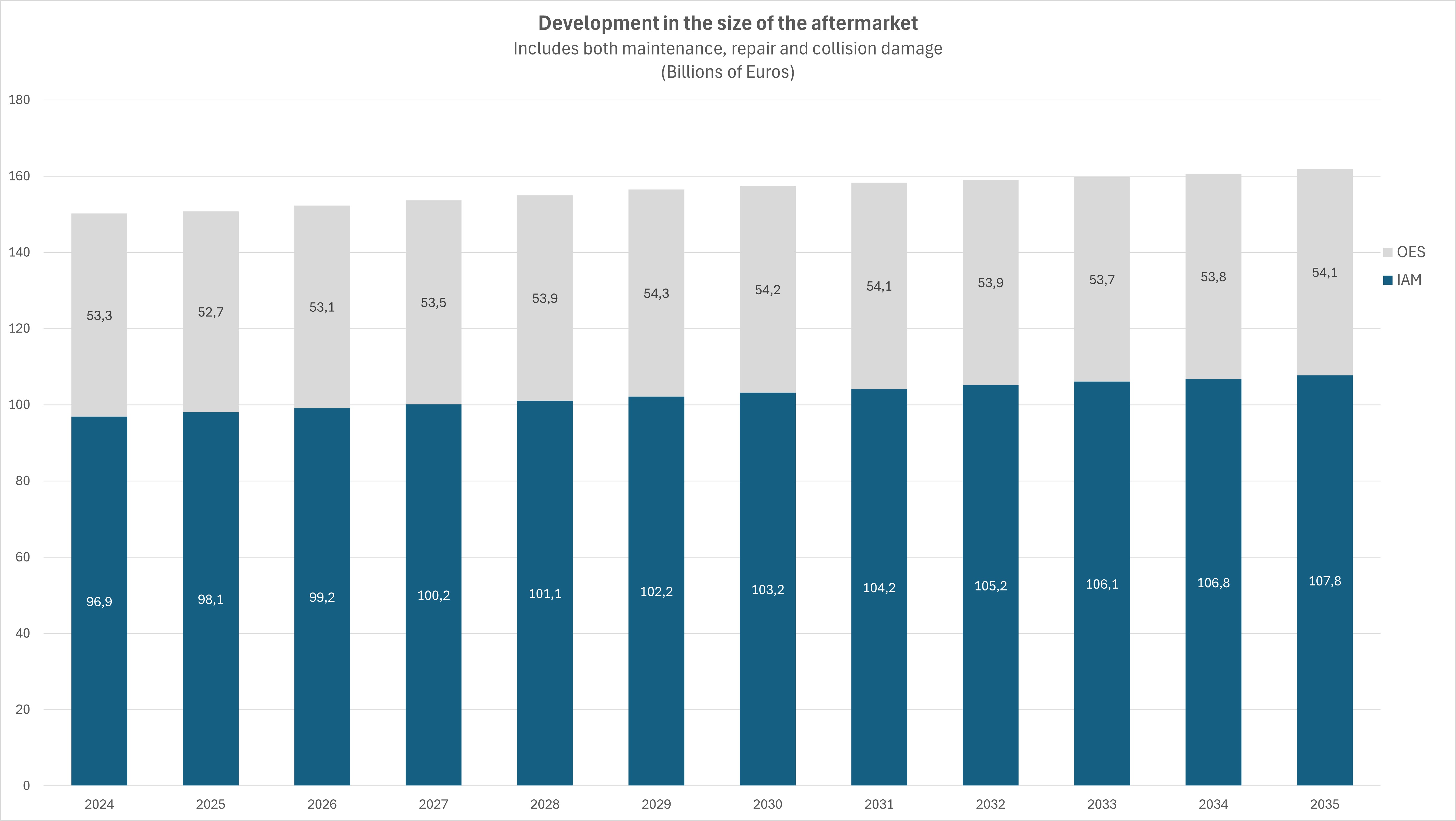

Assuming there is no influence from potential external factors, the aftermarket is expected to grow from EUR 150.2-161.9 billion by 2035. This corresponds to an annualized multi-year growth rate (CAGR) of 0.7%. In the section on future scenarios, the following is referred to as the "Baseline".

Development in the size of the aftermarket – Fig. 3

In 2024, IAM had a market share of 65% and OES the remaining 35%. By 2035, IAM's market share is expected to increase to 67%, whereby the OES share will decrease by 2% to 33%. The shift will primarily be driven by consumers' preference for cost-effective service options, especially as vehicles age.

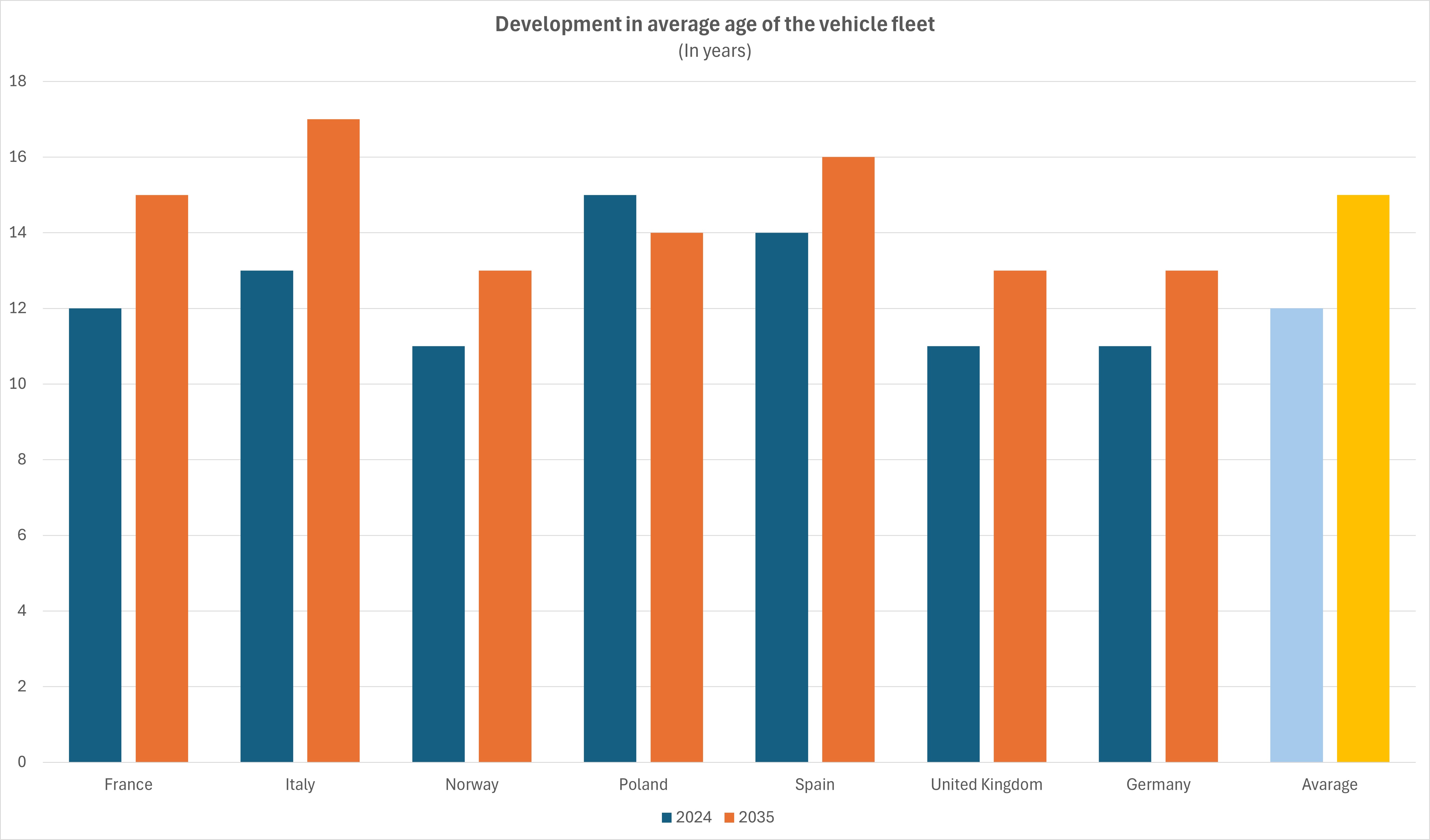

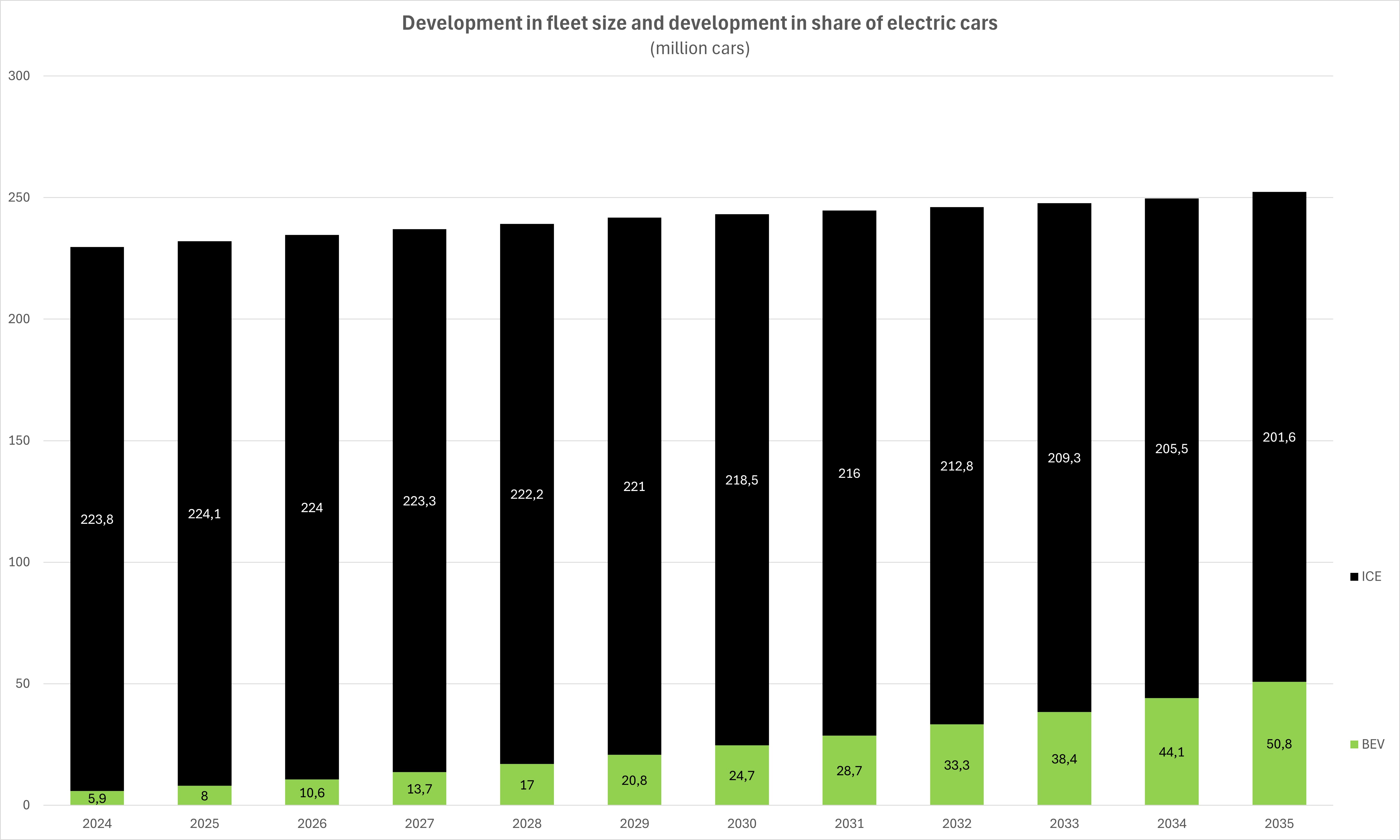

The total vehicle fleet is expected to grow from 230 million vehicles in 2024 to 252 million in 2035, with the average vehicle age increasing from 12.2 years to 14.6 years – with Norway as the only exception. Older vehicles tend to favor the IAM channel due to the lower repair costs.

Development in average life expectancy of cars – Fig. 4

The share of BEV in the automotive fleet is expected to grow significantly from 3% in 2024 to 20% in 2035 at a CAGR of 24.3%. This growth varies from market to market. In Norway, where the prevalence of BEV is already high, BEV is expected to account for 45% of the car fleet by 2035 with a CAGR of 6.1%.

Despite the fact that BEV generally results in lower service revenue per vehicle, overall market growth remains positive due to the increasing size of the car fleet and the increasing average vehicle age.

Development in fleet size and share of electric cars – Fig. 5

IWithin the overall aftermarket, growth is expected in both maintenance, repair and collision damage in the IAM channel. Driven by a lower cost level, vehicles older than six years are particularly likely to switch from OES to IAM. The following predictions of future developments are based on past trends and do not include the effect of the five key factors discussed in the next section.

Development in distribution between IAM and OES – Fig. 6

PARAMETERS THAT MAY CONTRIBUTE TO OEM TAKING MARKET SHARE FROM IAM

Based on a large number of interviews conducted with highly recognized experts across the entire aftermarket value chain, Berylls was able to conclude that the following five parameters were considered to be the most significant for whether IAM will lose market share to OEMs.

- Captive Parts

Parts produced or controlled by the vehicle manufacturer (OEM) as the sole source and/or parts distributed exclusively through the OEM and its network without an available alternative, such as parts subject to patents or design rights and parts produced for or by the OEM itself, such as proprietary design parts. Bonded parts also include parts that are produced by a supplier but contain software developed/owned by the vehicle manufacturer for cybersecurity protection and enablement. Approximately 20% of auto parts require activation due to cybersecurity issues.

- Cybersecurity measures

Measures to protect vehicles and their functions from potential cyber threats are mandatory. All vehicles sold in the EU from July 2024 must be equipped with a cybersecurity management system (CSMS) according to UN ECE R155. In addition, the ISO/SAE 21434 standard defines requirements for the safety management of electrical and electronic systems in vehicles. Most of these measures restrict access to the OBD port so that only authorized persons using OEM tools that communicate with OEM backends have access to, for example, activation of bonded parts and software updates.

- RMI/OBD data

Although independent operators should be guaranteed unrestricted and standardised access to technical information through the Type Approval Regulation (EU) 858/2018, this is not the case because OEMs do not always comply with the applicable legislation. With the introduction of cybersecurity measures, some OEMs have more or less closed access to OBD, while others are rejecting the provision of spare parts information in an electronically processable and machine-readable format. Such practices unnecessarily increase the cost of vehicle repair in independent workshops due to the need for additional work to develop spare parts catalogues and diagnostic tools as well as software.

- Software updates

Loading software updates is increasingly becoming part of the service and repair work. This work can only be effectively done so far using OEM tools, which can be purchased or rented from a Remote Support Service Provider (RSS). As the only alternative, the update procedure can be carried out via the vehicle's OBD connection. However, this method is not competitive because it is very time-consuming compared to using OEM tools. Manufacturers of multi-brand diagnostic tools are unable to develop and offer cost-effective solutions because vehicle manufacturers do not provide the necessary technical information

- Remote access to vehicle data, functions and resources

Access allows a service provider to exchange data and information with the vehicle – including diagnostic functions, setting parameters and interaction with the driver. The current legislation only ensures access to vehicle data and functions via the OBD port for diagnostic and repair purposes. Since 2016, a possible amendment to the Type-Approval Regulation to include remote access to vehicle resources and functions has been discussed, but OEMs strongly oppose it. It will allow independent operators to compete on a level playing field with car manufacturers, who have the ability to interact with connected vehicles and their drivers.

All of the above parameters are to a high or very high degree linked to the technology shift we have seen over the past decade with the introduction of connected cars and since BEV. They also allow all five car manufacturers to limit consumer choice and IAM's ability to compete on an equal footing.

Ensuring free and fair competition in the aftermarket as we know it is largely ensured by EU legislation in the area. The Motor Vehicle Block Exemption Regulation (MVBER) and its Supplementary Guidelines (SGL) aim to ensure IAM's ability to compete with the OES, while the Vehicle Type-Approval Regulation (TAR) ensures orderly conditions for technical aspects.

The MVBER Regulation has its origins in EU competition law and helps to ensure free competition in the internal market and prevent vertical cartelisation. The legislation aims to ensure that the distribution of vehicles, spare parts and related repair and maintenance services takes place under fair and competitive conditions, in order to ensure that consumers have a free choice.

In order to adapt EU legislation to the new technological reality, the European Parliament is working on an Automotive Industrial Action Plan. It includes an update of the MVBER regulation, a sector-specific data legislation (SSL) and the establishment of a Connected & Autonomous Vehicle Alliance (CAVA) which will become an EU platform for SDV vehicles with access to software, interfaces, standards and tools.

THE TWO MOST LIKELY FUTURE SCENARIOS

In the next edition of our newsletter, you can read the second part of this article where the two most likely scenarios for developments in the aftermarket will be explained.

___________________________________________________________________

ABBREVIATIONS USED

ADAS (Advanced Driver Assistance Systems)

BEV (Battery Electric Vehicles)

CAGR (Compound Annual Growth Rate)

CLEPA (European Association of Automotive Suppliers)

CSMS (Cyber Security Management System)

ECU (Electronic Control Unit)

FIGIEFA (Automotive Aftermarket Distributors)

HMI (Human Machine Interface)

IAM (Independent Aftermarket)

ICE (Internal Combustion Engine)

KIF (Key Influencing Factors)

MVBER (Motor Vehicle Block Exemption Regulation)

OBD (On Board Diagnostics)

OEM (Original Equipment Manufacturer)

OES (Original Equipment Supplier)

OTA (Over-The-Air)

RMI (Repair and Maintenance Information)

RSS (Remote Support Service)

SDV (Software Defined Vehicles)

SGL (Supplementary Guidelines)

TAR (Type-Approval Regulation)