It is not only the technology, but also the behavior of consumers that in recent years is changing significantly in the automotive aftermarket. As an independent workshop, you will inevitably have to deal with a new reality with changed market conditions. With new times come new opportunities, but also the necessity of having to make some choices. In the article series "The auto industry is changing rapidly - are you keeping up?" we focus, in this fourth and final article, on the future scenario for the independent workshops and significant factors that should be included in one's considerations when the business is to be future-proofed.

The speed at which market conditions for workshops are changing is not necessarily the same in all countries. It is therefore important to know the national conditions in order to be able to make the right choices as an independent workshop. The most important things to know and keep an eye on are described here.

Workshops in Europe

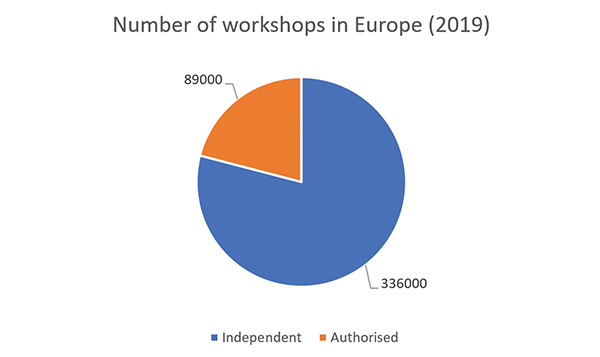

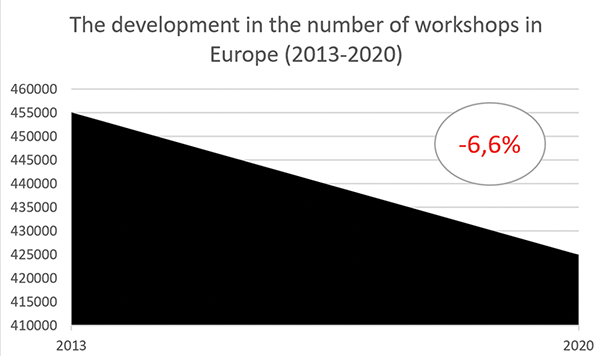

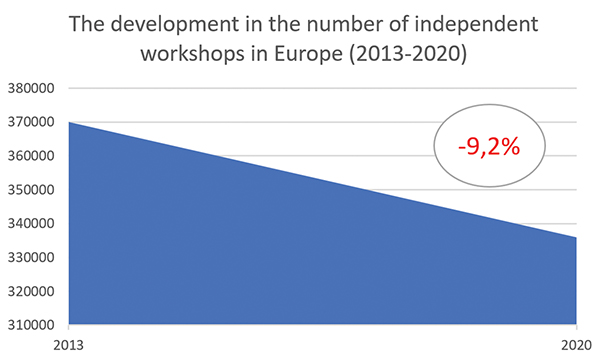

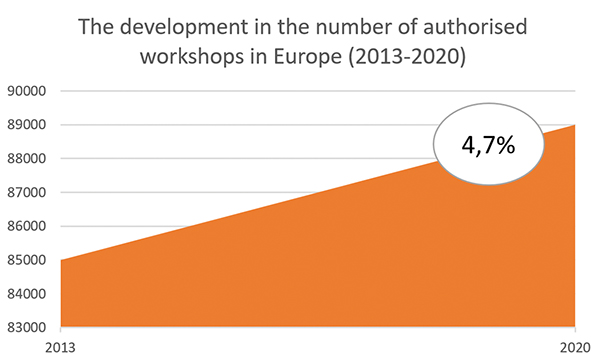

The number of workshops in Europe has been declining since 2013. With a decrease of approx. 7% there are today (2020) approx. 425,000 workshops. Of this, approx. 336,000 are independent and 89,000 are authorised workshops, but in most Nordic countries an equal division is seen between independent and authorised workshops. In general, there is a clear tendency for more small workshops to close and this often happens at the time where a generational handover or a sale becomes relevant.

Development of technology

With the use of increasingly advanced technology, it has become far more complex to service and repair the newer cars. Continuous training and investment in car brand-specific workshop equipment - both tools, diagnostics and calibration equipment - has therefore become almost inevitable. Since the introduction of connectivity technology, which is standard in cars produced from mid-2018, car manufacturers and authorised workshops have the advantage of being in constant dialogue with both the car and the driver. At the same time, with the introduction of this technology, car manufacturers are trying to cut off the independent workshops from being able to diagnose and service the vehicle.

The maintenance/workshop needs

The need for service and maintenance on conventional cars with internal combustion engines has been declining over time as service intervals become longer. Another trend seen in the market is the prevalence of service agreements/subscriptions, where car owners are offered service and repair of their vehicle for a monthly fixed fee. With the prevalence of electric and hydrogen cars, the need for service and repair will decrease further because the technology is far more simple. The number of parts in the driveline on an electric/hydrogen car is only approx. 200 in relation to approx. 1,400 on a conventional car. Fewer parts - less work.

Consumer behavior

Overall, the need for transportation in Europe is increasing and especially among the younger generation, there is a clear trend in relation to changing consumer behavior. Ownership is no longer ascribed the same meaning as it is among the older generation. Flexibility and predictability are given much higher value which leads to that consumers are more tempted to cover their need for transportation by purchasing services, which provides wind up in the sails for e.g. leasing and car-sharing companies.

But consumer behavior among traditional car owners is also changing. It is seen i.e. by an increased tendency to orientate oneself online. This applies to information on obtaining offers, spare part prices, repair costs and booking workshop times.

Composition and age of the fleet of cars

The speed at which market conditions for workshops are changing depends to a large extent on how far the development has come - in the above areas. A direct indicator of this is the composition of the car fleet and especially age. In recent years, the average age of Europe's fleet has increased to almost 13 years in 2019 and towards 2023, the fleet is expected to increase by almost 4.5% from approx. 375 to 392 million vehicles. But also, here great individual differences are seen from country to country. In countries with declining average age of the fleet, the development can i.e. be attributed to good social economy, widespread use of both business and private leasing and the possibility of subsidized purchases of electric, hydrogen and hybrid cars due to increased focus on the environment.

What should you, as the owner of an independent workshop, consider?

As previously mentioned, you should get thoroughly acquainted with the national, but also local conditions. The age and composition of the fleet is a good place to start, because it provides the answer to what extent the market conditions are affected by changed technological and consumer behavioral conditions.

Generally seen, the lower the average age of the fleet is, the more important it is - here and now - to consider which initiatives should secure the business for the future.

Another important area to focus on is your network of suppliers and in particular the initiatives and services the suppliers can contribute in relation to creating value and securing the business for the future. In Europe today, there are over 800 workshop concepts with over 110,000 affiliated workshops and the number is increasing. Maybe it's time to join a workshop concept or switch to something else and check out whether a concept includes a modern workshop management system with online bidding, booking and connectivity module, training, etc.?

When market conditions change, you must adapt and take advantage of the new opportunities that arise. With insight and consideration, you can make the right choices and secure a place in the future.

* Sources: HSH Nordbank, Roland Berger, TecAlliance