In the series of articles under the theme "The auto industry is changing rapidly" we have reached the second to last article. We give our bid on how the future will look like for spare part wholesalers in the automotive aftermarket.

Even though many operators in the automotive aftermarket sense a declining activity, an analysis from McKinsey shows that until 2030 the business worldwide expect an average growth of approx. 3% p.a. However, growth will be greatest in China and Asia, whereas in Europe we must settle for 1.5% p.a. If McKinsey’s analysis keeps up - and the market continues to develop favorably – how come many wholesalers are left with a different experience – and what circumstances have led to this?

New business models

The aftermarket business models, as we know them today, are being challenged. New business models aiming at direct distribution and partnerships with e-commerce companies or repair shops are heading forward. Many experts predict that the last-mentioned business models will gain significantly in relative short term.

New products and services

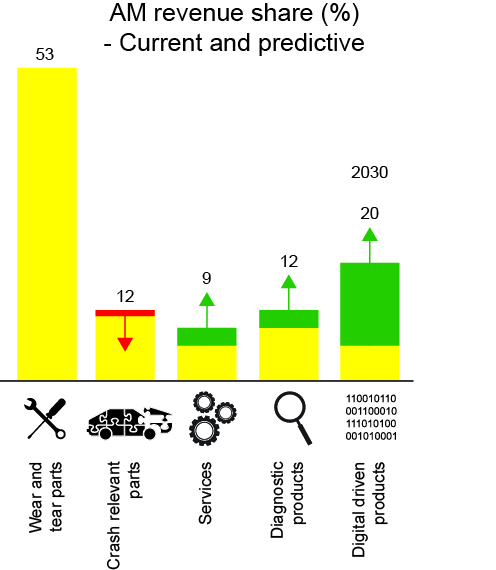

Regarding products, half of the earnings today still comes from the sale of wear parts, followed by crash relevant parts, diagnostic equipment and services as the largest product groups. In the future it is expected that the share in both numbers and turnover of wear parts will decrease due to increasing spare part quality and pricing pressure. The same applies to crash relevant parts that are also expected to decrease as a result of various safety systems in the vehicles gradually becoming standard. On the contrary, sales of diagnostic equipment and services are expected to grow due to the increased digitalization, new advanced technology and online access to car data. And exactly the last-mentioned digitally-driven products and services' share of turnover is expected to triple from 6% to almost 20% by 2030.

The circumstances above necessitate that, as a wholesaler in the automotive aftermarket, one must think carefully about the future strategy and business model. Especially 6 trends are essential to keep in mind.

Consolidation among spare part distributors

In the efforts to achieve critical mass and economies of scale, we will still see consolidations among spare part distributors and purchasing groups. Does it make sense to buy, sell or join a purchasing group?

OEM's expansion in the automotive aftermarket

As the average age of the car park globally has risen, the authorized part of the aftermarket has been forced to develop initiatives that either ensure that the car owners do not leave the authorized repair shop after 3-4 years or initiatives that ensure deliveries of spare parts to repair shops in the free aftermarket. The initiatives cover e.g. distribution of own spare parts via new channels - e.g. VW Direct Express or PSA's Distrigo and Mister Auto. But also the establishment of brand-neutral workshop chains (PSA's Euro Repair) or favorable services for older cars at the authorized repair shop (Opel Service Care 5+ & 10+). Another initiative is the offer of “connectivity” - typically the retro fitting of OBD dongles - Semler (VAG import Denmark), which links the car owner to the authorized repair shop.

Digitization

Consumers are increasingly doing research on the Internet prior to a purchase. Be it through product reviews, blogs and other digital platforms. Therefore, it is extremely important to work focused and professionally with ones digital presence. Especially through solutions based on connectivity, the possibilities become many, but also complex. As a spare part wholesaler, you will probably need to expand your IT skills or find a suitable partner with the necessary know-how.

Connectivity

As mentioned in several of the sections above, access to the data of vehicles and their owners can open up a whole lot of possibilities. Therefore, for most people it will be essential to have a digital strategy that includes connectivity. With access to data and the right analysis tools, you will gain important knowledge that can be turned into business opportunities. Of particular interest to spare part wholesalers and their repair shop customers is for example predictable maintenance - service and repair through the collection and analysis of data on eg. vehicle mileage, battery voltage, fault codes and similar. But also leasing, car rental, transport, car sharing companies etc. will have a great interest in having access to this kind of data as well as geo-data.

Greater influence from digital intermediaries

Exactly the aforementioned intermediaries will through access to vehicle data be able to manage and optimize service and repair of a whole fleet of vehicles. It is not difficult to imagine how a partnership between a spare part wholesaler and one of these intermediaries could be of mutual benefit.

Greater transparency on prices and greater supply

As mentioned under the section "Digitization", consumers are increasingly keeping themselves orientated digitally. Of course, this development also lead to greater transparency in prices and supply. It places high demands on pricing and makes it almost impossible to differentiate prices. The gross margin is under pressure and cross-border e-commerce is on the rise.

Although there is no indication that the future need for transport will be less - on the contrary - and analyzes show that the automotive aftermarket continues to grow, it is a market in which, as described in this article, new winds are blowing. New opportunities, but also new threats, make it imperative that you, as a spare part wholesaler, think carefully when discussing the plans for the future strategy and business development.

Test equipment for calibration - from Hella Gutmann